Kansas offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Kansas Government

Office of the Governor

Capitol

300 SW 10th Ave., Ste. 241S

Topeka, KS 66612-1590

Phone: (785) 296-3232

Toll Free: (877) 579-6757

Hours: M-F 8:00am – 5:00pm

Evergy

1710 Paseo Blvd.

Kansas City, MO 64108

(888) 471-5275

[email protected]

Hours: M-F 9:00am – 4:00pm

Kansas Energy Office

Kansas Corporation Commission – Energy Division

1500 SW Arrowhead Road

Topeka, KS 66604-4027

(785) 271-3184

[email protected]

Hours: M-F 8:00am – 5:00pm

Witchita Weather Bureau

2142 S. Tyler Road

Wichita, KS 67209-3016

(316) 942-3102

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| 2016- | 25% with a maximum amount of $1,000 | Individuals who install equipment from December 2010 to December 2021 |

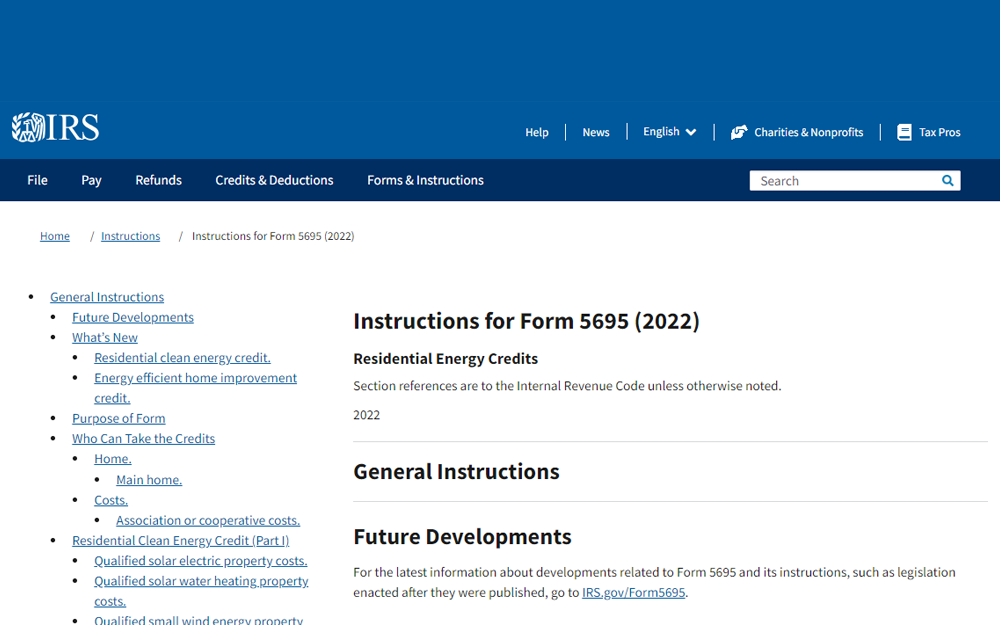

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Kansas Clean Energy

Kansas Renewable Energy Standard

Net Metering in Kansas

Programs and Incentives

Charge Up Kansas

Energy Natural Resources

Kansas Electric

Power Outage Map

Email

Division of Environment

Phone: (785) 291-3092

Email: mailto:[email protected]

1000 SW Jackson

Suite 400

Topeka, KS 66612

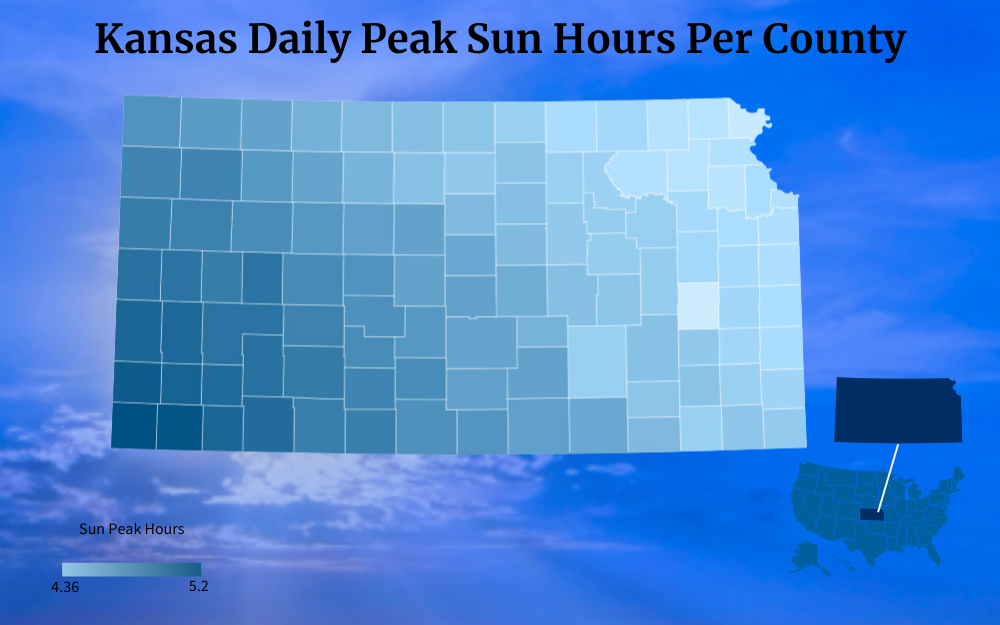

The state of Kansas has excellent viability for solar energy installation at both residential and commercial levels due to federal and Kansas solar incentives that lower the cost of solar panels in the state.

The relatively low cost of land, prominence of home-ownership, irradiance grade, and federal benefits make it an excellent choice for anyone who wants to reduce their energy costs and disconnect from the grid.

What Kansas Tax Programs for Solar Energy Are Available?

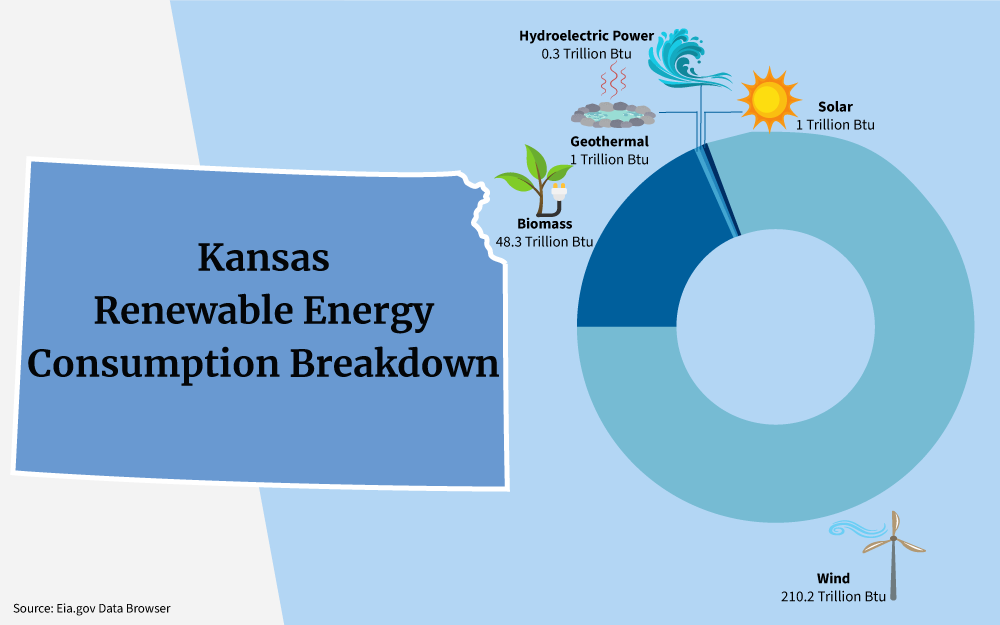

While the state does not have any unique Kansas solar incentives, Kansas residents are able to take advantage of the federal solar tax credit, which, even in states with unique incentives, is still usually the biggest one. Kansas residents can also take advantage of the practice of net-metering, or selling gathered electricity back to the grid to receive a rebate on energy costs.

Moreover, there are a number of renewable energy rebates that residents in Kansas can enroll in, and this complete guide explains how you can register now for solar tax credits, rebates and EERE programs to reduce your energy costs.

As a Kansas resident and individual solar customer (as opposed to a commercial entity),10 you will want to take advantage of the Federal Solar Tax Credit.

With this policy, when you spend money on installing a solar system, the US government can rebate you around 30% of the cost. It can be an extremely powerful incentive.

This type of tax credit is technically a type of Residential Clean Energy credit, which could apply to various projects, such as solar or geothermal, however, the most common type, and the one to be discussed here, is residential solar.1

It should be noted that in North America, by far the most common type of residential solar system is a Photovoltaic (PV) solar system. This system basically captures sunlight and converts it into AC used in home energy, so learning about how much sunlight your area gets is a good thing before having one installed.

This means it can be used for lights or the toaster or even sent back to the power grid for rebates. However, another type of home solar system is a water heater.

It uses a slightly different form of technology and basically heats a water tank directly so that there will be hot water available to the residence. This is more common outside North America however is still used there, especially by off-grid homes

These types of systems are indeed covered by almost all solar credits, including the federal tax credit, however, because they are far less common, and are not related to money-making practices like net metering, PV systems will be discussed in greater detail.5

What Is a Tax Credit and How Does It Work?

Claiming a tax credit from the government means that you are claiming a reduction on your income tax paid for that year. So as a hypothetical example, if you spend $10,000 on an eligible solar project, you could claim a $3,000 reduction on income tax for the year (provided it is a year where the 30% credit is in effect).

The purpose of this is so that the government can incentivize private individuals to install solar systems. It is an extremely powerful incentive.

The answer to ‘what are the individual limits on the federal solar tax credit?’ is there is none. The credit has no dollar lifetime limit, so there’s no cap on the amount you can receive.2

Federal Tax Credit Eligibility

For a more complete account of eligibility, the IRS media should be consulted. However, the basic eligibility requirements are as follows.6

First, your solar system must be installed within the year that the program is available. The percentage amount of the solar tax credit is set to fluctuate, pending congressional action. As of 2023, it will remain at 30% until 2033, when it is set to drop to 26%.

Second, the project should be on residential property in the United States. This definition is fairly broad and can include houses, apartments, or even houseboats and mobile homes.

Some states have special tax incentives for community solar programs but Kansas is not one of them. A solar system does not even need to be tied to the power grid to be eligible for the federal tax credit.

The most important things are that you can demonstrate ownership and that the system generates power for residential use.

Third, you have to own the solar system. This can mean that you purchased it outright, or through financing. But you will not qualify for having a system owned by somebody else installed on your property, for example, if you are leasing a system or charging a solar company to generate power from your property with the panels.

Fourth, the credit can only be used on the original installation of the solar equipment, which basically means the equipment has been used for the first time.

One way that residents can arrange solar for their houses is through what is known as a PPA agreement. They basically lease space to a solar company.

The company installs panels on the client’s roof, or elsewhere on the property and regulates a meter by which they charge the client per unit of electricity generated. It is extremely important to note that in this case, because the resident does not own the solar system, the costs of this service will not be eligible for the tax credit.

Customers who do not want to purchase the panels outright with cash, but still want to take advantage of the credit should consider financing arrangements. If instead of a PV solar system, you have installed a solar water heater system, this system would qualify if at least half of the energy used to heat the water is solar energy.2

Solar Tax Credit Eligible Costs

The solar energy credit can encompass a wide range of expenses.7 The largest of these will likely be equipment and labor costs associated with setting up your new solar system.

However, it is important to note that not every imaginable related cost would be covered. For example, if work needs to be done to the roof of your house to install the system that would not be covered.

Solar Tax Credit Application Process

Solar tax credit is just a shorthand term for a type of Residential Clean Energy Credit. This credit is filed with the IRS form 5695.8

You may have to supply additional documentation proving the cost of various components, installation, and permit fees, etc. Some solar providers will take care of much of the documentation for you, however, a tax specialist should be consulted to ensure you earn the maximum possible credit.2

- Gather Necessary Documents and Information: Prepare the receipts and records of expenses related to your solar energy system installation. Also, include the documentation showing the capacity and efficiency of your solar panels along with the manufacturer’s certification statement for the solar equipment installed.

- Download and Review the Form: Download Form 5695 from the official IRS website or tax software you’re using.

- Complete the Rest of Your Tax Return: Complete the rest of your tax return, including any other relevant schedules and forms.

Renewable Solar Energy Credits From the Government

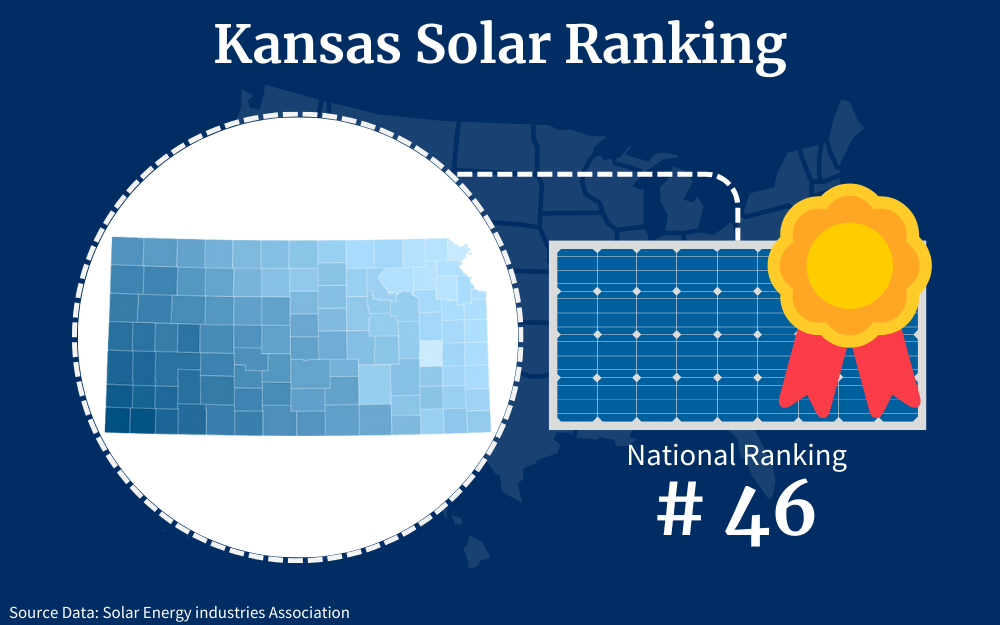

Unfortunately, at this time the State of Kansas does not offer many solar-specific energy programs, while other states have various things like Weatherization and Green Retrofit.

This could be a reason why Kansas ranked as one of the 10 states that have the lowest number of solar capacity in the country, however, low income households can apply for weatherization grants and funds.

The only significant incentives in Kansas are through the local government. Luckily these are usually the most profitable incentives anyway.

The US Office of Energy Efficiency and Renewable Energy also occasionally has funding opportunities that can concern individuals on their website. When these are posted, they will have detailed instructions on what to follow to apply for funding.

Most of these opportunities are open to all USA residents, regardless of location.

Can You Make Money From Net Metering?

The federal tax credit is an excellent way to save money on your solar system. However, net metering is how you can turn a profit. The basic idea of net metering is simple. Sometimes the energy you collect with your solar system will be enough to run your home.

Sometimes more, sometimes less. When it’s not enough you will be reliant, if not on batteries, then on the local utility grid to supply you power.

And of course, you pay for this. However, when your system produces more power than you need for your home, net metering allows you to send it back to the grid, and receive a rebate on your electric bill for the value of the energy you send back.

This basically means that you are selling energy back to the utility company. This can save you an enormous amount of money in the long run, or even eliminate electrical bills entirely.

This is how a solar system can turn you a profit in the long run.3

Net Metering in Kansas

The State of Kansas adopted its net metering policy relatively late, in 2009 (amended later) with the Net Metering and Easy Connection Act. This act entitled all customers of the investor-owned utility companies in Kansas to net metering.

Not all electric utilities in the state are required to offer net metering, only the investor-owned ones. Next, the Kansas Corporation Commission pushed through the standards for net metering.

The specifics for eligibility for net metering are as follows. The two investor-owned utilities in Kansas are Energy and Empire District.

They are required to offer net metering and a bi-directional meter (which measures the electricity to and from the house) for free on a first-come basis until the generating capacity of all the systems is up to just 1% of the utility companies’ peak demand for the prior year. This number of course is extremely low and is designed to benefit the utility companies at the expense of residential solar producers, or so-called ‘customer producers.

The qualifications for a customer-generator are that they should own and/or operate a system powered by renewable energy, on their property. It should be connected and operate in parallel with the utility system and of course, must be up to all safety standards.

The system should be offsetting the customer-generator’s own energy needs from the utility. It must also have a component by which it can be disabled automatically and stop the flow of electricity back to the utility in case of an issue.

As with the federal tax credit, theoretically, multiple types of renewable energy are eligible here including, solar, wind, hydro, methane from wastewater or landfills, etc. The most available for the average Kansas resident will likely be solar.3

Application Process for Energy Tax Credit

To apply for the federal tax credit, as stated above, you will need to submit IRS form 5695. Here are some things to keep in mind while filling it out.9

As stated, eligibility includes those who have made energy improvements to their USA-located home within the year. It does not have to be your main home but should of course be up to federal code.

Public utility subsidies for the improvement cost must be subtracted from the total amount before the calculation of the credit, even if a third party receives it on your behalf.

If you received a subsidy from a public utility for the purchase or installation of an energy conservation product and that subsidy wasn’t included in your gross income, you must reduce your cost for the product by the amount of that subsidy before you figure out your credit. This rule also applies if a third party (such as a contractor) receives the subsidy on your behalf.

Although most purely structural components of the solar project are not covered (for example, no roofing to support the system), this does not disqualify components. For example, some roofing tiles function both as structural roofing and solar collection. In this case, the roofing would be covered.

Although energy storage components are generally covered, costs like a hot tub or sauna which technically function as energy storage are not covered. Energy storage should be the sole function of the component.

If you occupy the residence jointly with someone other than your spouse and with whom you are not filing a joint tax return, it means that each individual resident should file their own 5695 Form.

If, along with your solar system, you made energy efficiency improvements to your house, follow the guidelines for submitting that information as well.2

Solar Panel Installation Costs in Kansas

According to statistics, the average price for a 5 kilo-watt solar system of around 15 panels, without (or before) receiving a fax credit is around $18,000, around $3.60 per watt in Kansas.

This will include the materials necessary, like the panels themselves, wiring, mounting, batteries, inverters and meters, etc. Of course, the cost of these materials can vary widely depending on the size, type, and quality of your setup, which is why the above cost is an estimate.

It also includes installation costs which are significant. While the upfront cost may seem daunting it is important to keep in mind that these systems usually pay for themselves in less than a decade.

So to maximize long-term profit, it is important to take long-term considerations when selecting the type of equipment and quality of the installer. Warranties and customer service can make a huge difference, especially because the lifespan of solar panels is often over 15 years.

Solar Calculator: How Much Can You Save?

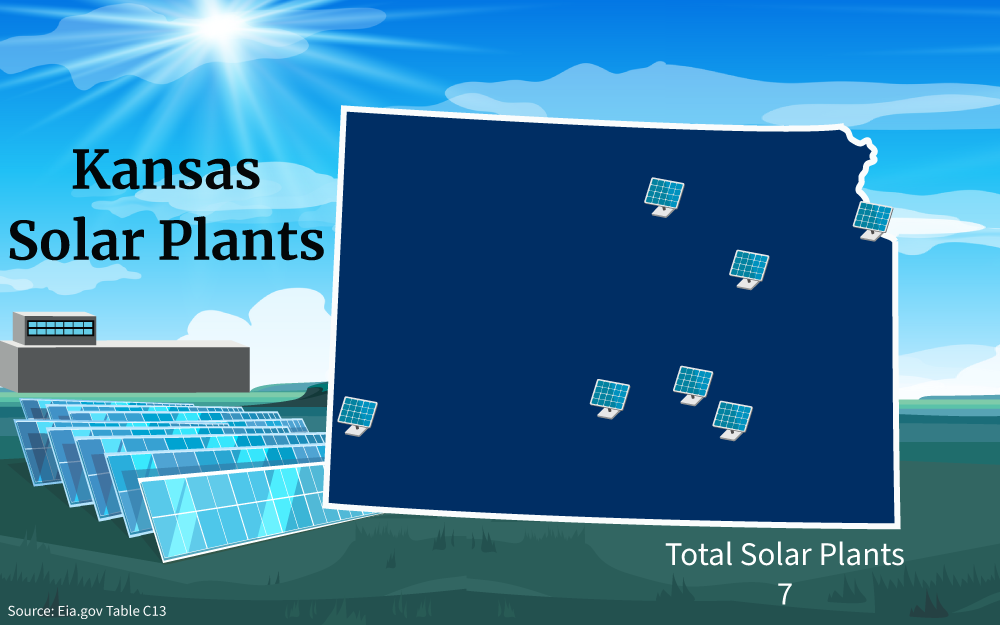

There are a couple of solar plants in Kansas but having one installed in your home will not only save you money, it will likely make you more bucks in the long run, thanks to net metering.

For example, assuming the average price of a 9KW system is just over $30,000, we can also assume an income tax credit from the government at around $10,000, assuming the system is eligible and qualifies. So already, thanks to the solar tax credit, the net cost of going solar is now just $20,000.

Now comes factoring in additional benefits from net metering. These are more difficult to estimate since they depend on the cost of energy, the exact output of the solar system, your own personal electricity use, and more, however, a basic estimate can be established.

If we take an average monthly electric bill of around $135.00. It means that, accounting for the tax credit, the system would pay for itself in under 13 years. Considering the longevity of solar panels, this means they will likely make you money in the long run.

These numbers can be estimated with a solar install calculator and solar power home calculator.

How To Choose Solar Panels in KS

According to statisitcs, the average price for a 5 kilo-watt solar system without (or before) receiving a fax credit is around $18,000, around $3.60 per watt. A 9 kilo-watt system with about 25-30 panels can be a little over $30,060.

Solar Panel Service

There are various considerations when selecting a solar installer. Often companies will offer similar prices, however, warranties, proposed timelines and customer service are extremely important factors.

You can also research solar panel information in the state, to learn which are the best photovoltaic panel options for your specific home.

Changing Regulations

Another factor is the company’s commitment to responsible panel life. While solar energy is considered clean energy or green electricity, the environmental impact of solar panels is significant.

Many people ask ‘are solar panels bad for the environment’ and most of the environmental damage is associated with the beginning and end of the panel’s life. It is likely that state and federal regulations surrounding this matter will change within the coming years.

Because solar panels lifespan will often exceed 15 years, companies with strong sourcing and recycling programs are more likely to succeed as the market conditions change. Consumers can position themselves well by purchasing from solar providers with strong recycling and ethical sourcing.

So, the truth about solar panels and going solar is that there is still environmental damage from solar panels, however, that damage is offset by the production of solar energy and can be greatly reduced by choosing a solar company with ethical and environmentally responsible solar panel production and recycling standards.4,11

Solar Installations can be profitable for Kansas residents. Most people think of residential KS solar panels installations as only environmentally motivated.

There certainly are good reasons to think that a solar power home is better than using electricity from your power grid, however, the potential economic benefits should not be overlooked.

Understanding how to use Kansas solar incentives to reduce the cost of solar panel installation for your home is just a matter of knowing where to look and how to maximize the options available.

Frequently Asked Questions About Kansas Solar Incentives

How Does the Federal Solar Tax Credit Work If I Don't Owe Taxes?

You should be aware that the Solar Tax Credit is non-refundable, which means it can only be used to reduce the amount of income tax owed and you cannot apply it to create a ‘negative tax balance’ and receive a free check from the government. However, any unapplied amount of the federal solar tax credit can roll over and you can apply it on your income tax for the following year.2

What If I Produce More Energy Than I Consume With Net Metering?

If the customer-generator began operating their system before July 14, net excess generation will roll over month to month and be credited against consumption if applicable; however, any net energy generation remaining in the balance by March 31 of each year will expire and be lost. If the customer-generator began operating their system after July 1, 2014, the difference is that, instead of being credited month to month at a 1:1 rate on the energy consumption (kWh), the net energy will be credited at a rate based on the monthly average price of energy and by January 2030, this will be the case for all customer-generators regardless of when system operation began.3

What Does A Solar Panel Do?

The questions of ‘what does a solar panel do?’ or ‘what is solar PV?’ often become dense scientific discussions, but the basic photovoltaics definition is that a photovoltaic panel has a group of cells that are composed of layers with a charge difference and this difference converts photons from sunlight into electrons in a direct current. Much more solar panel information can be found in the references below, but once you realize the power of PV technology you might even start wondering ‘how many solar panels to power the US?5

References

1Iscrupe, L. (2023, August 21). Kansas Solar Incentives: Tax Credits & Rebates Guide 2023. Saveonenergy.com. Retrieved August 26 2023, from <https://www.saveonenergy.com/solar-energy/kansas/>

2Rosen, A. (2023, August). Solar Tax Credit: What It Is and How It Works In 2023. Nerd Wallet. Retrieved August 26 2023, from <https://www.nerdwallet.com/article/taxes/solar-tax-credit>

3Kansas Corporate Commission. (2023). Net Metering in Kansas. Kansas Corporation Commission. Retrieved August 26 2023, from <https://www.kcc.ks.gov/electric/net-metering-in-kansas>

4Solartech. (2023). What to Do When Your Solar Panels Expire. Solartech. Retrieved August 26 2023, from <https://solartechonline.com/blog/solar-panels-expire/>

5Wikipedia. (2023, May 25). Solar Panel. Wikipedia. Retrieved August 26 2023, from <https://en.wikipedia.org/wiki/Solar_panel>

6Internal Revenue Service. (2022, December). Frequently asked questions about energy efficient home improvements and residential clean energy property credits. Internal Revenue Service. Retrieved August 31, 2023, from <https://www.irs.gov/pub/taxpros/fs-2022-40.pdf>

7Internal Revenue Service. (2022, December 27). Instructions for Form 5695 (2022). Internal Revenue Service. Retrieved August 31, 2023, from <https://www.irs.gov/instructions/i5695>

8Internal Revenue Service. (2023). Residential Energy Credits. Internal Revenue Service. Retrieved August 31, 2023, from <https://www.irs.gov/pub/irs-prior/f5695--2022.pdf>

9Solar Energy Technologies Office. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Office Of Energy Efficiency & Renewable Energy. Retrieved August 31, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

10Solar Energy Technologies Office. (2023, August). Federal Solar Tax Credits for Businesses. Office Of Energy Efficiency & Renewable Energy. Retrieved August 31, 2023, from <https://www.energy.gov/eere/solar/federal-solar-tax-credits-businesses>

11U.S. Environmental Protection Agency. (2023, June 20). Solar Panel Recycling. U.S. Environmental Protection Agency. Retrieved August 31, 2023, from <https://www.epa.gov/hw/solar-panel-recycling>

12Screenshot of IRS Instructions for Form 5695. Internal Revenue Service. Retrieved from <https://www.irs.gov/instructions/i5695>

13Solar Array at Kansas City International Airport. Photo by Kansas City.gov. Retrieved from <https://www.kcmo.gov/city-hall/departments/city-manager-s-office/solar-farm)>